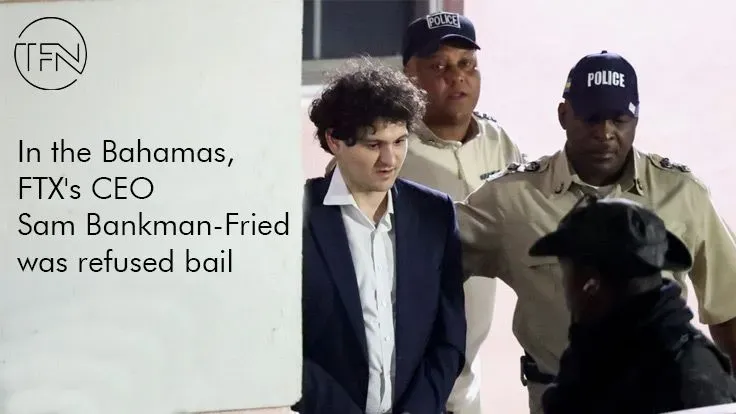

A court in the Bahamas has decided not to grant bail to Sam Bankman-Fried, who was the creator of the cryptocurrency exchange FTX before it went bankrupt.

On Tuesday, US officials accused Mr. Bankman-Fried of committing "one of the largest financial scams in US history."

Gary Gensler, the chair of the Securities and Exchange Commission (SEC), said that the former head of FTX created a "house of cards on a foundation of lies."

Mr. Bankman-Fried has made it clear that he intends to contest his extradition to the United States.

The plea for his release on bail was refused by Bahamas Chief Magistrate JoyAnn Ferguson-Pratt, who cited a "great" danger of flight in her decision. Instead, she ordered that he be sent to a place where people are held until February 8.

On Monday, he was taken into custody in the Bahamas.

After filing for bankruptcy in the United States a month ago, FTX has left many of its customers unable to withdraw their money. A document submitted to the court said that FTX owes its 50 biggest creditors a total of roughly $3.1 billion (£2.5 billion).

The claim that Mr. Bankman-Fried used tens of billions of dollars worth of client assets to prop up his investment trading firm, Alameda, is one of the most severe claims made against him.

It is not certain how much money customers who have funds in the exchange will receive back after the bankruptcy processes are complete; nevertheless, numerous experts have cautioned that it may only be a tiny portion of what they first put in.

Mr. Bankman-Fried is being investigated for eight different criminal offenses in the United States, including money laundering, wire fraud, and conspiracy to defraud. He is being sued because he lied to investors who put more than a billion dollars into the company.

Additionally, officials have accused him of breaking regulations about campaign money.

Damian Williams, the US Attorney for the Southern District of New York, said at a press conference on Tuesday that the alleged scheme Mr. Bankman-Fried ran was "among the biggest in the history of the United States."

Mr. Williams not only accused Mr. Bankman-Fried of scamming lenders, investors, and consumers; he also stated that Mr. Bankman-Fried had utilized "tens of millions" of ill-gotten earnings for illegal political donations to both Democrats and Republicans.

According to Mr. Williams, "all of this filthy money was utilized in the service of Fried's to purchase bipartisan influence and affect the course of public policy in Washington."

In past interviews with the media, the crypto tycoon has admitted to making mistakes, but he has denied wanting to trick his customers.

Mr. Bankman-Fried has also denied that he must have known that FTX customers' money was being used by Alameda Research, a trading company that was connected to FTX.

At one point in time, many compared him to a younger counterpart of the famed American investor Warren Buffett. As recently as the end of October, it was reported that he had a net worth of more than $15 billion (£12.1 billion).

Meanwhile, the new chief executive of the company, John Ray, testified before a congressional committee in the United States and said that it looked like the failure of FTX was caused by the company being managed by a small number of "grossly unskilled, non-sophisticated persons."

He said that he had seen "a complete absence of record-keeping and absolutely no internal controls at all."

Customers were able to swap traditional currencies, such as dollars, for cryptocurrencies like bitcoin on the FTX market.

Cryptocurrencies are not currencies in the conventional sense; rather, they are held digitally online and behave more like investment vehicles or stocks, albeit often exhibiting a great degree of volatility.

Since they are anonymous, they have become popular for engaging in illegal activities like trading drugs and launching ransomware attacks; yet, others who favor them argue that there is a significant opportunity for innovation and independence from governments.